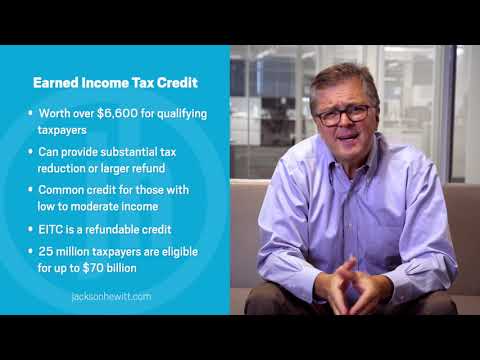

Hi, I'm Mark Stever, Chief Tax Information Officer at Jackson Hewitt Tax Service. Today, I'm here to tell you about the Earned Income Tax Credit, also known as the EITC. For qualifying taxpayers, the EITC can be over $6,600. When the EITC is added to other credits, it can provide a substantial tax reduction and a potentially greater refund for eligible taxpayers. The EITC is a well-known and popular credit for taxpayers with low to moderate income. It is a refundable credit, which means you receive the money added to your tax refund regardless of the taxes you had withheld or paid in estimated payments. Annually, millions of taxpayers qualify for this valuable credit. In fact, the IRS reports that there are about 25 million eligible workers and their families that qualify for up to $70 billion of earned income tax credits each year. However, the EITC can be a complicated credit. According to the IRS, one out of five taxpayers fail to claim the credit each year, leaving millions of dollars on the table. Additionally, eligibility for the EITC can change year to year. If a taxpayer didn't qualify for the EITC last year, they may qualify this year. The IRS states that about one-third of EITC eligible taxpayers turnover annually. With the significant increase in unemployment this year, it may impact who qualifies for the EITC. For example, if you normally qualify for the EITC but have been unemployed this year, you may not have enough earned income to qualify for the same amount as in the past. On the other hand, if you've never qualified for the EITC before and your household income is less this year, dropping below $5,100, you may be eligible to claim this valuable credit for the first time. So, how do you qualify for the EITC?...

Award-winning PDF software

Earned Income Tax Credit Or Eitc For 2025 - Efilecom: What You Should Know

Earned Income Tax Credit Overview: Earned Income Tax Credit FAQ's When Is the Earned Income Tax Credit (ETC) Taxable in My State? The Federal Earned Income Tax Credit (ETC) is available to taxpayers with modest or zero earned income. However, states have their own earned and qualifying income limits, so the ETC does not always apply. States that have the EIC is refundable, but it is not taxable In states where the ETC is tax-free, the credit itself is taxable on the state return (the first page of “returns” to “filing status”). The income limits vary, so you may need to file a federal tax return. The tax credit is not tax-free if you pay taxes on it — it is, however, tax-free if you use the credit as a deduction at the end of the year. Do I need a Social Security number to claim the ETC? If you're single, and you file Form 1040A (1040) and do not have a Social Security Number, the ETC will reduce the amount of federal income taxes you owe. For a couple who files a joint return, the credits are refundable. The credit will be refundable if you don't have a Social Security number. However, they can't claim the ETC if they are claimed as a dependent on another individual's federal or state return. What is the Earned Income Tax Credit (ETC) for 2017? The Earned Income Tax Credit (ETC) is a refundable tax credit aimed at helping families with low to moderate earned income. The ETC credit is phased out with a modified adjusted gross income (AGI). A taxpayer's AGI must be below the income limit of 25,150 for 2017. If the AGI exceeds the ETC amount, a taxpayer must file a tax return (Form 1040) to get the ETC. The maximum amount of the maximum credit is 6,728. However, the refundable amount is only 3,050 for 2025 and 3,650 for 2025 and 2025 (but not back to tax year 2025 unless the refund does not exceed the maximum credit).

Online options assist you to organize your document administration and raise the productivity of the workflow. Adhere to the short information as a way to finished Earned Income Tax Credit or EITC for 2025 - eFilecom, steer clear of errors and furnish it inside a timely fashion:

How to complete a Earned Income Tax Credit or EITC for 2025 - eFilecom online:

- On the website together with the kind, simply click Initiate Now and move towards the editor.

- Use the clues to fill out the appropriate fields.

- Include your individual facts and call facts.

- Make convinced that you choose to enter correct material and quantities in best suited fields.

- Carefully check out the content material belonging to the kind at the same time as grammar and spelling.

- Refer to help you segment should you have any queries or address our Guidance staff.

- Put an digital signature on the Earned Income Tax Credit or EITC for 2025 - eFilecom aided by the assistance of Indication Device.

- Once the shape is completed, push Done.

- Distribute the all set type by means of email or fax, print it out or conserve on the machine.

PDF editor will allow you to definitely make adjustments with your Earned Income Tax Credit or EITC for 2025 - eFilecom from any on-line linked machine, customize it according to your requirements, indication it electronically and distribute in different ways.

Video instructions and help with filling out and completing Earned Income Tax Credit Or Eitc For 2025 - Efilecom